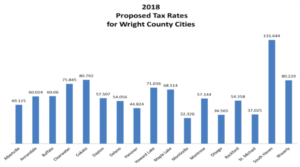

Out of the 17 cities in Wright County, St. Michael taxpayers enjoyed a long run of having the lowest tax rates in the county. However, changes have led St. Michael to slip into the third-lowest ranking, behind Monticello and Otsego.

“We had some big years in the late 90s and early 2000s for our tax capacity growth, which helped make this happen,” city administrator Steve Bot explained.

St. Michael’s current measured growth rate couldn’t compete with Monticello, whose nuclear generating plant completed an expansion two years ago that added the equivalent of 2,000 homes to the city’s tax base value. This caused their tax rate to drop from 44.672 in 2014 to 35.732 in 2015. Monticello’s rate has dropped even lower since then, now at 32.326 for 2018.

Otsego now has the second-lowest tax rate in Wright County, whose residential and industrial growth has outpaced St. Michael’s in recent years. Their tax rate is just slightly lower than St. Michael. St. Michael still ranks below neighboring Albertville, which falls more toward the middle of the pack with the 7th lowest tax rate in Wright County.

Tax rates are calculated by dividing the property tax revenue needed in a jurisdiction by its total tax capacity.

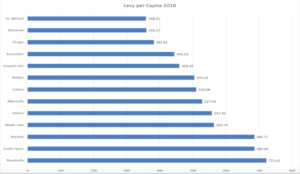

Despite slipping to the number three spot, St. Michael does have the lowest levy amount per capita in Wright County at 358.31. On the other end of the spectrum lies Monticello, whose levy per capita is 721.62. Albertville again falls in the middle of the pack at 527.59 per capita.

Tax levies in Wright County rose between 1.1 percent (Annandale) and 10.5 percent (Howard Lake) for 2018. Albertville had a 2.9 percent increase. The city said increasing expenditures will be partially offset by the increased number of building permits. New home permits are expected to top 100 next year for the first time in over a decade.

Why the Increase?

The city’s legal settlement with Riverside Church, which added $120,000 to the levy, is the largest single factor behind the increase. St. Michael settled a lawsuit in September 2017 with Riverside Church for $2,650,194 after the city was found liable for violations of the church’s freedom of speech and assembly. The church had initially filed a six-count complaint and claimed the city caused $9.5 million in damages, but five of the complaints were thrown out. This settlement is paid for partially by the city’s insurer, but the city’s share is $1.2 million. The city raised its tax levy 2 percent to help pay this settlement.

The St. Michael city council approved an inter-fund loan from the city’s sewer fund to pay the settlement sum in full, which will be paid back incrementally with the additional levy funds. However, Bot said the inter-fund loan will be evaluated regularly and could be paid back sooner if feasible.

Other larger increases to the levy include a $79,000 increase to the parks and street maintenance fund to cover increasing expenses of aging infrastructure and an additional $60,000 for the Economic Development Authority levy.

“The EDA is in need of more funds to help meet economic development goals of our city council, which includes helping existing business succeed as well as attracting new businesses,” Bot said.

He said EDA funds projects that the council believes will have an overall benefit to local residents and businesses. For instance, he said the recent expansion of public parking in the downtown area is an example of an EDA-funded project.

Individual property owners will also see increases due to higher property values, as St. Michael residences increased in value by 5.09 percent for the 2017 assessment. The average home value in the city is now $257,800 versus $248,200 last year. Commercial property values increased by 1.20 percent for taxes payable in 2018.