Early voting on the St. Michael-Albertville school district’s bond referendum is in full swing, and the actual election day is less than three weeks away, on Feb. 7. Superintendent Dr. Ann-Marie Foucault just completed her 77th meeting with local groups about the upcoming bond, and she’s not done yet.

Meanwhile, the Vote No voice has grown louder over the past few weeks over social media and in a recent yellow flyer mailed to district residents by a group identifying themselves as STMA Voices.

Due to the numerous questions the school board and superintendent have been getting about the payment structure of the bond, Dr. Foucault reached out to the district’s financial consulting firm, Ehler’s Inc., to get some clarification.

“The yellow flyer was not deliberately misinformative, but incomplete, and we want to give voters the most information as we can,” Foucault said.

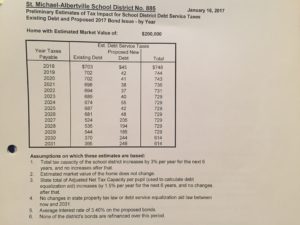

So, at Foucault’s request, Ehler’s put out additional information on the debt payment structure the board has currently approved for this bond, including what they call “very preliminary estimates” of the tax impacts for future years.

“Our standard practice with school districts planning debt issuance is to provide detailed information on the tax impact for the first year of taxes only,” the letter from Ehler’s stated. “Because there are so many factors that can cause changes in tax impact over time, it is impossible to accurately project tax impact for specific parcels of property in later years, especially 10-14 years from now.”

The letter from Ehler’s went on to say that because of the numerous questions the district has received and because some residents have circulated “misleading estimates of tax impact in future years,” the company agreed to prepare more specific information about the potential tax impact in future years.

A home in the STMA school district with a taxable market value of $200,000 will pay $703 annually for existing school debt in 2018, which is due to the district building two elementary schools and a new high school over the past 15 years. The proposed new debt would add $45 to that total in 2018.

This bond payment number would stay fairly constant-Ehler’s estimates range between $37-$55 per year for a $200,000 home from 2018-2026. In 2027, other building debt begins to fall off, and that is when taxpayers will begin paying a larger share of their taxes toward the proposed bond. Their preliminary estimates show that a $200,000 home may pay $205 in 2027 toward the bond, or $17 per month, but the homeowner’s total debt service payment will not change due to other building debt falling off. Total debt service will remain the same through 2029 even though the bond payment will be higher.

During the last two years of the bond, 2030 and 2031, homeowners would see a reduced number for total debt service even though the bond would cost the owner of a $200,000 home just under $250 per year each of those last two years, due again to other school building debt falling off. 2031, the last year of the bond payments, would be the highest payment for a $200,000 home at $248 that year, which is $20 per month. However, other existing debt will have fallen to $366 by then, making the total estimated debt service $614 that year.

“The goal is to keep the tax rate stable,” Foucault said.

Ehler’s stated that these numbers will inevitably be different from the estimates, particularly in the later years of the bond, but said that since they used conservative assumptions in their estimates about the growth in the district’s tax capacity, the interest rate and refinancing of debt, they believe it is likely that the actual tax impact will be less than their estimates.

“It is certain that not all of these assumptions will hold true from now-2031,” the letter stated.

The assumptions they used are as follows:

1. Total tax capacity of the school district increases by 3 percent per year for the next six years, and no increases after that.

2. Estimated market value of the home does not change.

3. State total of Adjusted Net Tax Capacity (used to calculate debt equalization aid) increases 1.5 percent per year for the next six years, and no changes after that.

4. No changes in state property tax law or debt service equalization aid law between now and 2031.

5. Average interest rate of 3.4 percent on the proposed bonds.

6. None of the district’s bonds are refinanced over this period.

The letter also noted that these preliminary tax impacts do not include the impact of the state Property Tax Refund “Circuit Breaker” program. Based on income and total property taxes, many owners of homestead property will qualify for a refund. Ehler’s said this will decrease the net effect of the proposed bond issue for many property owners.

The last public meetings about the bond will take place today, Thursday, Jan. 19, at 9:30 a.m. and 7 p.m. The morning meeting takes place at St. Michael City Hall, and the evening meeting takes place at the STMA High School’s Performing Arts Center.

Paul says

The yellow flyer was in response to the STMA school district’s numbers misinforming taxpayers with half-truth. The yellow flyer simply uses the district’s own numbers to calculate the actual estimated cost of THIS bond, while the districts initial numbers attempted to hide the fact that the cost of THIS bond skyrockets after the initial interest-only period. The district was hiding the increase over time inside reductions of our currently existing debt as we pay it off. The whole truth is, they plan to increase taxes on a $200k home by $45/year in the beginning, AND wipe out a tax cut that is scheduled to kick in right about the time the bond payment skyrockets. Why were they unwilling to tell the whole truth right from the beginning? Why did it take our completely honest assessment of their numbers to compel them to reveal the whole truth?

Because it wasn’t until the yellow flyer revealed the district’s attempt to obfuscate the whole truth that the district was forced to reveal it. The very day after Eric Jon Boone’s Letter to the Editor came out, the whole truth appeared on the district website like magic.

So rather than this article taking the tone that the Vote No group is “loud” and misinformed, how about everyone recognize that our efforts provided you with a glimpse at the truth the district was perfectly content to deny you.