The St. Michael city council approved plans for the construction of two new businesses at their meeting last week.

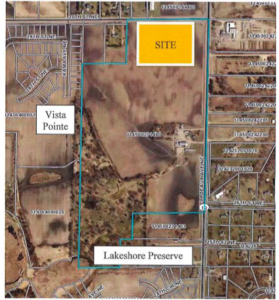

The first is a set of 22 mini-storage buildings owned and operated by Affordable Self Storage. The company previously proposed building on land at the intersection of Naber Ave. and Highway 241, but that would have required a comprehensive plan amendment, and the city received substantial negative feedback on the proposal from nearby residents. Now the project has been approved in a new location on the southwest corner of CSAH 19 and 30th St. on the south side of town. The city council approved a comprehensive plan amendment in April to allow industrial uses on the site.

However, the city did not receive any negative feedback about the proposed Die Technologies and Nanotechnologies precision manufacturing facility on the same 12 acre parcel as the storage units were initially proposed. Die Tech plans to build a 30,000 square foot facility on the southwest corner of Naber Ave. and Highway 241. They are also planning a future 15,000 square foot addition in the future.

Die Tech currently operates out of Osseo, but St. Michael city administrator, Steve Bot, said the business was looking to expand operations. The city voted to rezone this parcel to allow Die Technologies and Nanotechnologies to move in, as the land was formerly zoned agricultural land. City leaders said this zoning is typical for large parcels of unplatted land. The parcel is now zoned B-3 for business and office park, which the comprehensive land use plan called for in that space.

The St. Michael city council also voted to approve a TIF (tax increment financing) district for the construction of Die Technologies/Nanotechnologies. This means the businesses will ultimately pay taxes only on agricultural land value rates for its first nine years.

St. Michael’s community development director, Marc Weigle, said the TIF will make the project financially feasible for Die Technologies and will serve the larger goals of helping to provide employment opportunities, improve the tax base and the state’s economy. The city council agreed the development wouldn’t be expected to occur solely through private investment in the reasonable future, and they also felt the increased market value of the site would, in the longterm, more than offset the projected tax increments. The proposed development will increase the land’s market value by approximately $3.8 million.